Quick Links

- Why the Risk Register Remains the Backbone of Risk Management

- What Is a Risk Register?

- The Core Components of a Risk Register

- How to Build a Risk Register: Step by Step

- Risk Assessment vs. Risk Register

- Who Is Responsible for Creating and Maintaining the Risk Register?

- Real Examples of High Quality Risk Register Entries

- Common Mistakes to Avoid in Risk Registers

- Upgrading from Static to Dynamic Risk Registers

- Risk Register Best Practice for 2026

- FAQs

The Complete Guide to Risk Registers: Structure, Templates, and Best Practice

In late 2023, a ransomware incident at the British Library forced the organization to shut down core systems and limit services for months. Recovery was complex and highly visible. It showed how a single attack can disrupt operations, damage reputation, and attract attention from regulators and the public.

Across sectors, similar cyber attacks, supply chain disruptions, and cloud outages show how quickly risk now moves across an extended enterprise. A single incident can affect customers, partners, and regulators in hours. Boards expect clear evidence that organizations understand their material risks and track them in a consistent way.

A risk register is one of the simplest tools in a governance, risk, and compliance program. It is also one of the most powerful.

A well-designed risk register:

Brings strategic, operational, cyber, compliance, and financial risks into one place.Uses consistent risk scoring so leaders can compare entries.

Links each risk to owners, controls, and actions.

Supports clear reporting to the board and regulators.

This guide is written for senior risk, compliance, and GRC leaders. It will help you understand what a risk register is and why it matters, build one from scratch, see best practice examples, avoid common mistakes, and move from static spreadsheets to more dynamic, intelligence-driven registers.

Why the Risk Register Remains the Backbone of Risk Management

Modern organizations rarely rely on a single risk register. Variants appear across enterprise risk, operational risk programs, cybersecurity risk registers, compliance and regulatory reporting, and project and program risk registers. The challenge is not only to list risks, but to keep each register focused, accurate, and usable.

Treat the risk register as a living tool, not a filing cabinet. Done well, it becomes the backbone of your risk management program and a single source of truth for risk-based conversations.

What Is a Risk Register?

A risk register is a structured record of the risks that could affect an organization, project, or program, along with their ratings, owners, and responses. By capturing risks in a consistent format, it helps leaders see what matters most and decide what to do next.

At enterprise level, a risk register contains strategic, financial, operational, cyber, and compliance risks that could affect business objectives. At project level, a risk register focuses on delivery threats such as schedule delays, cost overruns, supplier failures, or technical uncertainty.

Purpose of a Risk Register

The purpose of a risk register is to:

- Capture identified risks in a structured and consistent format

- Support visibility so risks do not sit hidden inside teams or systems

- Enable prioritization so attention goes to material risks

- Underpin mitigation planning and ongoing monitoring

- Help each risk owner make decisions based on standardized risk scoring instead of guesswork

Risk registers were popularized in project management and have since expanded into wider enterprise risk management frameworks. Today, they are foundational in internal audit, operational risk, cybersecurity, and regulatory reporting.

The Risk Register in the Risk Management Cycle

You can place the risk register inside a simple risk management cycle:

Identify → Assess → Evaluate → Treat → Monitor → Report

Risk identification and risk assessment activities produce the input. Workshops, interviews, data analysis, and scenarios uncover what could go wrong and how serious it might be. The risk register is the single source of truth where these outputs are captured in a repeatable way for ongoing use.

A risk register is not the same as risk identification or assessment

- Risk identification and assessment are activities

- The risk register is the record that stores the results

“A risk assessment helps you understand the danger. The risk register keeps track of everything that could go wrong and what you are doing about it.”

The Core Components of a Risk Register

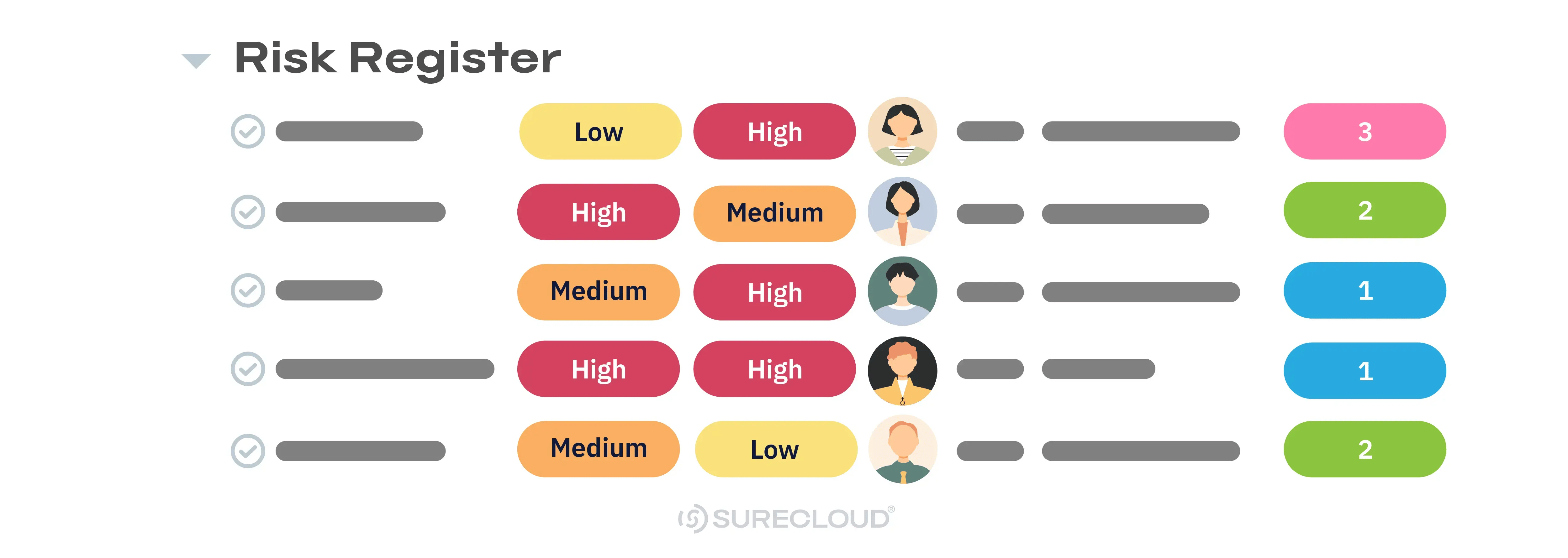

A good risk register template does more than list risk titles and colour ratings. It captures enough structured information for risk owners, audit teams and senior leaders to understand each risk clearly and compare risks consistently.

The table below sets out the core components of a well-designed risk register, along with their purpose and examples.

| Component | What it captures | Why it matters | Example |

|---|---|---|---|

|

Risk ID |

A unique identifier for each risk |

Prevents confusion and supports audit trails |

R-2025-014 |

|

Risk title |

Short, clear name for the risk |

Allows quick scanning of the register |

Payment service outage due to third-party failure |

|

Full risk description |

Clear statement of the risk and its context |

Avoids vague entries and clarifies what could go wrong |

Failure of the third-party payment gateway could prevent customers from making online payments, leading to lost revenue and complaints |

|

Cause |

Underlying reasons the risk could materialise |

Informs control design and mitigation actions |

Single point of failure in the payment provider and limited failover testing |

|

Consequence / impact description |

What happens if the risk occurs |

Supports meaningful impact scoring and communication |

Missed sales, customer dissatisfaction and potential regulatory scrutiny |

|

Risk category |

Type of risk (for example strategic, operational, cyber, compliance) |

Enables reporting by category and dashboard views |

Operational risk, linked to the cyber risk register |

|

Likelihood score |

Probability of the risk occurring, using a defined scale |

Enables consistent scoring across risks |

Likelihood 4 on a 1–5 scale |

|

Impact score |

Severity of impact if the risk occurs |

Distinguishes minor issues from material threats |

Impact 5 on a 1–5 scale |

|

Overall risk rating |

Combined likelihood and impact score |

Drives prioritisation and escalation |

High risk (4 × 5) |

|

Inherent risk rating |

Risk level before any controls are applied |

Shows raw exposure |

Very high |

|

Residual risk rating |

Risk level after existing controls |

Demonstrates control effectiveness and gaps |

Medium after new controls |

|

Controls in place |

Key preventive and detective controls |

Connects risk to control design and assurance |

Daily backups, quarterly access reviews, real-time monitoring |

|

Mitigation plan |

Planned actions to reduce risk further |

Turns risk awareness into action |

Implement multi-region failover, strengthen supplier due diligence |

|

Risk owner |

Person accountable for managing the risk |

Risks without owners rarely move |

Chief Information Security Officer |

|

Assurance / oversight owner |

Independent oversight function |

Supports audit and second-line challenge |

Head of Internal Audit |

|

Status |

Current state of the risk |

Signals direction of travel |

Open, actions on track |

|

Target risk score |

Desired residual rating after actions |

Aligns risk management to appetite |

Medium within six months |

|

Review date |

Next planned review |

Embeds a regular review cycle |

30 June 2025 |

|

Linked records |

Related incidents, controls, KRIs or audits |

Connects risk to evidence and outcomes |

Incident INC-2025-017, Control CM-12, Audit IA-2024-03 |

The Simplest Possible Risk Register

At its most basic, a risk register can consist of just three elements:

| Core element | Description |

|---|---|

| Risk Description | What could go wrong and why |

| Risk Owner | Who is accountable |

| Risk Rating | How serious the risk is |

However, this level of detail is rarely sufficient for modern organisations. Most corporate risk registers require the additional components above to support governance, assurance and informed decision-making.

Rather than starting from scratch, use a risk register template that includes these fields and tailor it to your organisation’s size, sector and regulatory obligations. A full example template is available at the end of this guide.

How to Build a Risk Register: Step by Step

The seven stages below form a practical framework you can apply to an operational risk register, a cybersecurity risk register, or a project-level risk register.

Use a single example risk to illustrate each step, such as a ransomware attack on core customer systems that disrupts services.

Step 1: Identify risks

Use a mix of methods:

- Workshops and risk brainstorming sessions

- Scenario analysis and tabletop exercises

- Interviews with business and technical stakeholders

- Horizon scanning for regulatory, geopolitical, and technology change

Think about where risks originate

- Strategy and business model

- Technology and data

- Operations and processes

- Suppliers and third parties

- People and culture

Example: you identify the risk that a ransomware attack on core customer systems could disrupt access to critical services and data.

Step 2: Categorize risks

Apply a clear taxonomy so risks can be grouped and reported consistently:

- Strategic

- Financial

- Operational

- Cyber

- Compliance and regulatory

Consistent categorization supports reporting, heatmaps, and alignment with enterprise risk views.

Example: you categorize the ransomware scenario as an operational and cyber risk linked to your core customer platform.

Step 3: Assess impact and likelihood

Choose a scoring model that matches your needs:

- 3 by 3

- 4 by 4

- 5 by 5

Define what low, medium, and high impact look like in your context

Example: based on sector incidents and your own environment, you score ransomware likelihood as 3 of 5 and impact as 5 of 5.

Step 4: Prioritize based on scoring

Use risk scores to decide which risks need attention first:

- Plot risks on the heatmap

- Apply red, amber, green thresholds

- Compare scores against risk appetite and tolerance

High-scoring risks above appetite become priority items for action and closer monitoring.

Example: the 3 by 5 ransomware score places this risk in the red zone on your heatmap, above appetite, so it becomes one of your top priority risks.

Step 5: Assign risk owners

Every material risk should have a named owner:

- Risk owner: Accountable for the overall risk and its treatment

- Action owners or managers: Responsible for specific mitigation tasks

- Oversight functions: Provide challenge and independent assurance

Example: you assign the CIO as risk owner, security and IT operations managers as action owners, and internal audit as the oversight function for ransomware risk.

Step 6: Define controls and mitigation actions

Document both existing controls and planned actions.

- Preventive controls: Aim to stop the risk from materializing

- Detective controls: Help you spot events quickly when they occur

Example: for the ransomware risk, you record existing controls such as email filtering, endpoint protection, patching, and backups, and add actions to improve restore testing, tighten patching SLAs, and expand phishing training.

Step 7: Establish monitoring and reporting

Decide how you will monitor the risk and how often you will review it

- Set review frequencies based on risk rating

- Define key risk indicators

- Integrate risks into regular reporting to executive and board level

Example: for the ransomware risk, you set quarterly reviews, define KRIs such as phishing click rates and backup success rates, and include the risk in your regular executive risk report.

Risk Assessment vs. Risk Register

Many teams still confuse risk assessments with risk registers, so it helps to draw a clear line between them.

What is the difference between a risk assessment and a risk register?

A risk assessment is the process of identifying, analyzing, and evaluating risks. It is an activity.

A risk register is the structured record of those risks, their scores, owners, controls, and actions. It is the log that stores the results of assessments and ongoing monitoring.

In simple terms:

- Risk assessment produces understanding

- The risk register keeps that understanding organized and usable over time

Risk assessments feed the risk register. Assessments generate scores, impact descriptions, and recommendations, and those outputs become structured entries in the register with IDs, owners, ratings, controls, and actions.

|

Aspect |

Risk assessment |

Risk register |

| Purpose |

Understand and analyze risks |

Store and track risks and responses over time |

|

Timing |

Performed at defined points |

Updated as risks, controls, and actions change |

| Output |

Scores, insights, recommendations |

Structured entries with fields, ratings, and status |

| Format |

Workshops, reports, slide decks, worksheets |

Log, spreadsheet, or GRC platform view |

|

Stakeholders |

Facilitators, experts, risk owners |

Risk owners, management, internal audit, and regulators |

Example: you run a risk assessment on phishing attacks against staff. The assessment identifies scenarios, scores likelihood and impact, and notes vulnerable groups and existing controls. It concludes that ransomware delivered via phishing could disrupt key services and trigger regulatory notifications.

Those details then become a structured entry in the cybersecurity risk register. You assign a risk ID, title, and description, record likelihood and impact scores and an overall rating, link existing controls, add mitigation actions, and assign a risk owner and review date.

Who Is Responsible for Creating and Maintaining the Risk Register?

In practice, the risk register is prepared and updated by risk owners and their teams, coordinated by the central risk or compliance function. Different parts of the organization contribute entries and updates for their areas, using a common template and governance model.

Typical Ownership Models

Ownership depends on the context:

- Enterprise risk: risk and compliance team, coordinating a corporate risk register

- Operational risk: department leaders or process owners, maintaining operational risk registers

- Project risk: project managers, maintaining project risk logs and registers

- Cyber risk: security team in partnership with the central risk function, maintaining the cybersecurity register

Role of the Risk Owner

The risk owner is accountable for:

- Monitoring the risk and its indicators

- Deciding whether the level of risk is acceptable

- Making sure actions are defined and completed

- Keeping entries up to date in line with review dates

Role of Senior Leadership and the Board

Senior leaders and the board:

- Approve risk appetite and tolerance

- Review high-impact and emerging risks

- Challenge whether risk registers are complete and aligned with strategy

- Use risk register outputs to inform priorities and decisions

Simple RACI Example

For a high-impact cyber risk such as ransomware:

- Responsible: security and IT operations managers

- Accountable: CIO as risk owner

- Consulted: business unit leaders and the data protection officer

- Informed: executive committee and board risk committee

Auditors and assurance teams validate risk data and test whether the register is accurate, complete, and supported by evidence in controls, incidents, and reporting.

Real Examples of High Quality Risk Register Entries

Concrete examples of risk registers help translate theory into practice. The examples below show how detailed entries can be structured and then adapted to your organization’s context.

Example 1: Cybersecurity Risk

- Description: Ransomware attack on core customer systems that disrupts services and access to data

- Cause: Phishing emails, unpatched vulnerabilities, and limited restore testing

- Impact: Service outage, restoration effort, regulatory notifications, and reputational damage

- Likelihood: 3 of 5 based on sector incidents and current controls

- Rating: Inherent very high, residual high

- Controls: Email filtering, endpoint protection, patch management, network segmentation, offline backups

- Actions: Improve backup restore testing, tighten patching SLAs, expand phishing training, review incident response playbooks

- Owner: Chief information security officer

- Next review: 30 June 2026

Example 2: Regulatory Non-Compliance

- Description: Failure to comply with new data protection requirements affecting customer data in key jurisdictions

- Cause: Incomplete mapping of personal data, third-party processors, and cross-border transfers

- Impact: Regulatory fines, remediation costs, increased oversight, and reputational damage

- Likelihood: 2 of 5, reflecting partial preparation and limited visibility of suppliers

- Rating: Inherent high, residual medium

- Controls: Data protection impact assessments, privacy training, contract reviews, records of processing activities

- Actions: Complete data mapping, update supplier contracts, implement privacy by design checkpoints in change processes

- Owner: Data protection officer

- Next review: 31 March 2026

Example 3: Data Loss

- Description: Accidental deletion or corruption of critical financial data that cannot be quickly restored

- Cause: Manual processing errors, broad admin access, and lack of change control on key systems

- Impact: Delayed financial reporting, audit findings, and potential misstatements in management information

- Likelihood: 3 of 5 given current manual steps and access patterns

- Rating: Inherent high, residual medium

- Controls: Role-based access control, change control for financial systems, daily backups, backup integrity checks

- Actions: Reduce admin access, introduce approvals for bulk changes, strengthen backup monitoring, test restore procedures more frequently

- Owner: Head of finance operations

- Next review: 30 April 2026

Example 4: Operational Service Outage

- Description: Extended outage of the key customer service platform affecting contact center and online self-service

- Cause: Single cloud region dependency, limited failover capability, and incomplete disaster recovery testing

- Impact: Inability to serve customers, complaints, churn, and potential breach of service level agreements

- Likelihood: 3 of 5 based on current architecture and incident history

- Rating: High

- Controls: Monitoring and alerting, documented disaster recovery plan, vendor support arrangements

- Actions: Implement multi-region failover, perform regular disaster recovery tests, review vendor resilience and contract terms

- Owner: Director of customer operations

- Next review: 31 May 2026

Example 5: Financial Liquidity Risk

- Description: Insufficient liquid funds to meet short-term obligations during a period of revenue stress or market disruption

- Cause: High reliance on short-term funding, limited cash flow forecasting, and slow access to contingency credit lines

- Impact: Inability to meet payment obligations, covenant breaches, higher funding costs, and loss of stakeholder confidence

- Likelihood: 2 of 5 in normal conditions, rising in stressed scenarios

- Rating: Inherent high, residual medium

- Controls: Cash flow forecasting, liquidity buffers, committed credit facilities, investment limits, treasury policies

- Actions: Enhance stress testing, increase liquidity buffers, renegotiate credit facilities, tighten working capital management

- Owner: Chief Financial Officer

- Next review: 30 September 2026

Common Mistakes to Avoid in Risk Registers

Even experienced teams can fall into common traps when creating and maintaining risk registers. Recognizing these patterns makes it easier to avoid them.

Typical Issues

- Vague risk descriptions with no clear cause or consequence

- Recording issues and incidents instead of genuine uncertainties

- Too many risks and no sense of priority or risk appetite

- Missing or unclear risk owners

- Out-of-date scoring that does not reflect current controls or environment

- Missing controls or actions, so the register becomes only a list of worries

- Inconsistent formats across business units, making aggregation difficult

- Static spreadsheets that are rarely updated or linked to incidents, KRIs, or audits

“An inaccurate risk register is more dangerous than having no risk register at all.”

The goal is not to list everything that could go wrong. It is to maintain a focused, accurate, and actively managed view of the risks that matter most.

Upgrading from Static to Dynamic Risk Registers

Many organizations still manage risk registers in spreadsheets. This can work at small scale, but it has clear limits, with no audit trail, version control problems, manual risk scoring, and fragmented reporting. As the number of risks, owners, and linked controls grows, static files make it harder to trust and act on the data.

Dynamic or platform-based registers inside a GRC solution address many of these gaps. They can provide

- Real-time scoring and aggregation

- Dashboards for executive and board-level reporting

- Automated reminders for reviews and action due dates

- Links between risks, controls, incidents, audits, and key risk indicators

- Change history and audit trails

Modern GRC platforms such as SureCloud Enterprise and SureCloud Foundations make it easier to maintain an integrated, real-time risk register that connects risks, controls, incidents, audits, and monitoring data in one place. Instead of chasing different versions of a spreadsheet, risk owners work from a single view that updates as actions, incidents, and controls change.

Risk Register Best Practice for 2026

Expectations around best practice for risk registers continue to rise. Regulators, boards, and assurance functions want to see clear links between risk appetite, risk registers, and the decisions leaders make.

Key Practices

- Integrate risk appetite statements into scoring and thresholds

- Use scenario-based risk analysis to enrich impact descriptions

- Review high and medium risks at least quarterly

- Link risks with controls, KRIs, audits, incidents, and key suppliers

- Cross-reference with frameworks such as ISO 31000, ISO 27005, COSO, and NIST RMF, and with guidance from NCSC and the Institute of Risk Management

- Provide clear guidance for project managers so project-level risk logs roll into corporate views

- Identify emerging risks and flag them explicitly

- Define clear escalation paths so high-risk items reach leadership quickly

- Use a common template and taxonomy across business units to support aggregation and reporting

Taken together, these practices help keep the register aligned with enterprise risk management, operational resilience, and assurance expectations, rather than treating it as a static compliance document.

Short Checklist

- Is the risk clearly defined?

- Does it have a meaningful owner?

- Are controls relevant and accurate?

- Does the scoring match real-world impact and likelihood?

- Is the status and review date current?

Frequently Asked Questions

What are the three components of a risk register?

In the simplest model, a risk register has a risk description, a risk owner, and a risk rating. Modern risk registers add fields for causes, controls, actions, and review dates so risks can be managed over time, not just listed once.

How do you build a risk register?

Identify and categorize risks, assess impact and likelihood using a consistent scoring model, prioritize based on scores and risk appetite, assign risk owners, document controls and actions, and set a review and reporting cadence using a standard risk register template.

What is the difference between a risk assessment and a risk register?

A risk assessment is the activity of identifying, analyzing, and evaluating risks. A risk register is the structured record of those risks, their scores, owners, controls, and actions, so they can be tracked and reported over time.

Who prepares the risk register?

Risk registers are prepared and updated by risk owners and their teams, usually coordinated by a central risk or compliance function, with project managers, security teams, and business leaders contributing entries for their areas.

How detailed should a risk register be?

It should be detailed enough for someone outside the team to understand the risk, see who owns it, and know what is being done about it. Keep entries concise and use linked documents for deeper analysis if needed.

How many risks should be in a risk register?

There is no fixed number. Focus on risks that are material to your objectives and risk appetite, and use separate operational or project-level registers where you need more granularity that can roll up into a concise corporate view.

What makes a good risk register?

A good register uses a consistent template and taxonomy, has clear owners, links to relevant controls and evidence, and is reviewed on a regular schedule so it supports prioritization and decision making.

What tools are used to manage risk registers?

Smaller organizations sometimes use spreadsheets or simple risk logs. Many mid to large organizations use GRC platforms such as SureCloud Foundations to maintain integrated risk registers with workflows, dashboards, and links to controls, incidents, audits, and monitoring data.

What is the difference between a risk register and an issues log?

A risk register records uncertain events that may happen in the future. An issues log records problems that are already happening; risks can turn into issues, but they should be logged and managed separately so you can distinguish potential threats from active incidents.

Tools and Guidance for Managing Risk

Your Risk Register as a Living Source of Truth

A risk register is more than a compliance document. It is the backbone of a robust risk management program when kept accurate, complete, and active.

Organizations that treat the register as a continuously monitored tool gain stronger visibility across projects, operations, and enterprise risk, more confident decisions at executive and board level, and clearer evidence for regulators, auditors, and other stakeholders.

The next step is to review your current register against the structure, examples, and best practices in this guide. Identify gaps, adopt a consistent risk register template, and consider how a modern GRC platform like SureCloud can support risk tracking, monitoring, and integrated reporting.

A well-maintained risk register will not remove uncertainty. It will help you understand, prioritize, and respond to it in a consistent, transparent way.

“In SureCloud, we’re delighted to have a partner that shares in our values and vision.”

Read more on how Mollie achieved a data-driven approach to risk and compliance with SureCloud.

.png)