Achieve Seamless DORA Compliance with SureCloud

Simplify compliance with the Digital Operational Resilience Act using SureCloud’s automated GRC software — helping financial services meet regulatory requirements, reduce risk, and strengthen resilience.

Trust Badges

What is the Digital Operational Resilience Act (DORA)?

The Digital Operational Resilience Act (DORA) is a new EU law that protects financial services from digital disruptions. It makes sure that banks, insurers, investment firms, and ICT providers can keep operating during cyberattacks or system failures. Even if your business is outside the EU — like in the UK — you still need to follow DORA rules if you serve EU financial markets.

The goal of DORA is to make digital risk management stronger and more consistent across Europe’s financial sector. It sets clear standards for how firms should prepare for, respond to, and recover from digital threats.

Why DORA Compliance is Essential for Your Business

Staying compliant with the DORA regulation is critical for financial institutions and ICT providers operating in or serving the EU. It’s not just a legal requirement — it’s a strategic way to protect your operations, reputation, and customers.

Key requirements of DORA regulation

To become DORA compliant, organizations must implement:

- Managing IT and cyber risk across your systems and vendors

- Reporting major incidents quickly and clearly

- Testing your digital resilience regularly

- Monitoring third-party providers for operational risks

- Keeping detailed records to show regulators you’re in control

Key reasons to prioritize compliance

• Avoid regulatory fines and enforcement actions

• Strengthen resilience against digital threats and disruptions

• Ensure continuity with third-party providers

• Build trust with customers, stakeholders, and regulators

By aligning with the Digital Operational Resilience Act, your organization demonstrates strong governance, reduces operational risk, and builds long-term resilience in a fast-changing digital environment.

How SureCloud Simplifies DORA Compliance

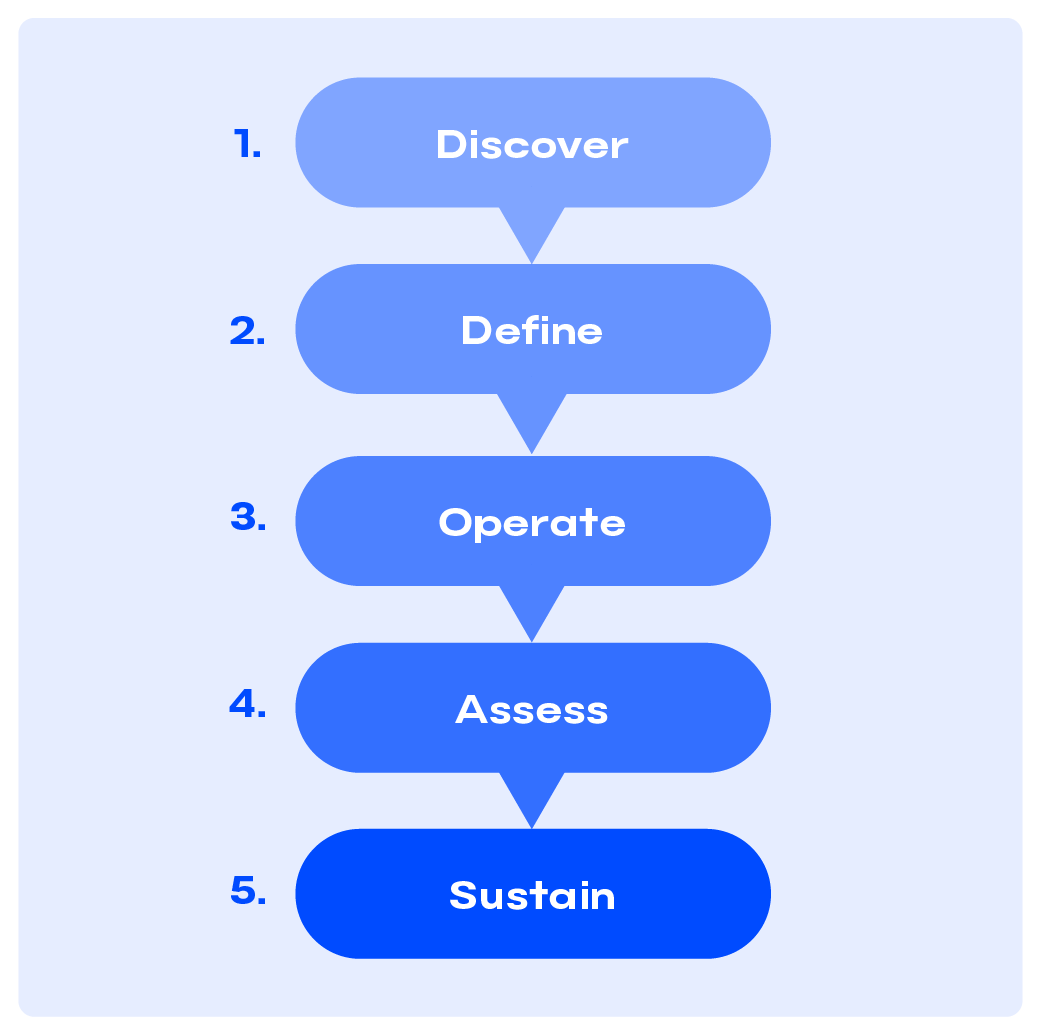

SureCloud breaks down the DORA compliance journey into clear, manageable steps. Our platform supports every stage — from risk identification to automated reporting — so your team can stay in control and avoid compliance gaps.

Step-by-step process:

- Assess: Identify your digital assets, systems, third-party dependencies, and operational risks.

- Plan: Build your DORA-aligned strategy, assign responsibilities, and set control measures across your organization.

- Monitor: Track ICT risks, third-party performance, and policy compliance in real time with dynamic dashboards.

- Report: Automate reporting workflows to meet DORA’s regulatory deadlines and maintain full audit trails.

The Benefits of Achieving DORA Compliance with SureCloud

DORA compliance isn’t just about ticking a regulatory box — it’s a long-term investment in your organisation’s digital resilience. SureCloud’s platform helps you reduce complexity, save time, and build trust while preparing for the Digital Operational Resilience Act (DORA).

Why choose SureCloud?

Mitigate risks and strengthen resilience:

Stay ahead of cyber threats and IT disruptions with built-in tools for real-time risk and control monitoring.

Reduce compliance costs and overhead:

Eliminate manual tracking and reduce resource strain through automation and centralized documentation.

Enhance customer trust and protect your reputation:

Demonstrate clear governance and operational strength to clients, partners, and regulators.

Gain operational agility and confidence:

Adapt quickly to regulatory changes and scale your compliance strategy across teams, regions, and third-party ecosystems.

Trusted by Leading Financial Institutions

SureCloud is trusted by major financial institutions and ICT providers across the EU and beyond. Our platform supports organizations of all sizes — from fast-scaling fintechs to global banks — in meeting DORA compliance with confidence.

Learn More About DORA Compliance

Want to dive deeper into the Digital Operational Resilience Act and what it means for your organisation?

Download our in-depth guide to understand the full scope of the DORA regulation and how to prepare your business for compliance success.

How SureCloud Helps You Achieve DORA Compliance

SureCloud offers a purpose-built solution designed to help financial institutions and ICT providers meet every aspect of the DORA regulation. From automation to audit-readiness, our GRC software reduces the complexity of compliance and keeps your digital operations resilient.

Key features include:

Automated Incident Reporting

Capture, track, and respond to incidents in real time with structured workflows that meet DORA's incident handling requirements.

Comprehensive Risk Assessment

Identify and assess ICT risks across systems and processes with a single platform.

Third-Party Risk Management

Monitor and manage external ICT providers with dedicated oversight tools, contract tracking, and compliance checks.

Continuous Monitoring and Compliance Tracking

Maintain an always-on view of control effectiveness, deadlines, and policy status to stay audit-ready year-round.

With SureCloud, your organization gains a connected, end-to-end approach to DORA compliance — from initial planning through to operational execution.

Learn More About DORA Compliance

Want to dive deeper into the Digital Operational Resilience Act and what it means for your organisation?

Download our in-depth guide to understand the full scope of the DORA regulation and how to prepare your business for compliance success.

Frequently Asked Questions

What is the Digital Operational Resilience Act (DORA)?

DORA is an EU regulation that requires financial institutions and their technology providers to manage and report digital risks. It sets rules for IT security, incident response, third-party oversight, and operational resilience.

Who needs to comply with DORA?

Banks, insurers, payment providers, investment firms, and ICT third-party service providers operating in or serving the EU must comply. This includes UK and global firms with EU clients.

How does SureCloud help with DORA compliance?

SureCloud provides a centralized GRC platform to manage risk assessments, incident reporting, vendor oversight, and control tracking — all aligned to DORA’s requirements.

What are the key requirements of DORA compliance?

Firms must implement ICT risk governance, detect and report incidents, manage third-party providers, run resilience testing, and maintain clear documentation. SureCloud maps each of these requirements to specific workflows.

How does SureCloud automate DORA incident reporting?

SureCloud facilitates the full lifecycle of incident management — from logging and reporting to triage, task assignment, documentation, and audit-ready reporting — all within a centralised platform.

Is SureCloud’s DORA compliance solution scalable for large financial institutions?

Yes. SureCloud supports complex compliance structures with multi-entity management, user roles, and scalable automation for growing regulatory needs.

.png)

_HighPerformer_Enterprise_HighPerformer.png)