GRC Software for Financial Services

Manage Growing Regulatory Complexity and Enterprise Risk with SureCloud – the Intelligent GRC Platform for Compliance and Resilience at Scale

Take Control of Compliance and Risk

Regulatory demands and business risks are changing faster than ever

For financial institutions, keeping up isn’t enough—you need to take command. SureCloud’s GRC software for financial services puts every compliance, risk, and third-party management task in one powerful platform. The result? Your teams move faster, spot threats sooner, and show regulators and leaders you’re in control.

Enterprise GRC is No Longer Optional

The old way of working—manual processes, scattered tools, endless fire drills—just can’t keep up with frameworks like DORA and Basel III. The pressure is real: 62% of teams say disconnected systems make it harder to manage risk. Boards and regulators want answers in real time, not excuses.

Are you facing these challenges?

Struggling with Legacy Tools

Chasing Proof During Audits

Lacking Visibility Across Borders

Drowning in Spreadsheets

Consolidate. Automate. Take Command.

Built for modern finance, SureCloud’s compliance software for banks lets you manage risk, meet regulations, and prove control—without the chaos.

What You Can Do with SureCloud

Unified Risk

Register

Track every risk and owner as it happens

Configurable Workflows

Instantly adapt to DORA, ISO, NIS2, SOX, and more

Executive Dashboards

Deliver answers to leaders before they even ask

Continuous Monitoring

Get alerts that help you prevent, not just react

TPRM for financial institutions

Stay ahead of vendor threats and supply chain issues

What Enterprise Financial Teams Achieve with SureCloud

With SureCloud’s GRC software for financial services, your teams don’t just keep up—they get ahead. Enterprise risk management for banks becomes a strategic advantage, not a burden.

See the impact:

Save up to 40% on audit prep time, freeing teams for higher-value work

Board-ready reports, on demand, turn data into insight in seconds

A single, real-time risk view, spot gaps and act before issues escalate

Stay ready for anything, scale controls as your business, and the rules, evolve

Automate the admin, let financial compliance automation handle the routine, so your people focus on what matters

Built for the Financial Sector

From global banks to fast-growing fintechs

SureCloud’s regulatory compliance software powers risk and compliance for the world’s most demanding financial teams. See how industry leaders stay audit-ready and resilient—no matter the pressure.

A Simple Flow to Enterprise GRC Control

Whether you need a quick win or a full GRC transformation, SureCloud’s regulatory compliance software is simple to roll out and easy to scale.

Steps to Enterprise GRC Success

Connect

Bring risk, compliance, and vendor data into one source of truth

Automate

Use workflows built for enterprise risk and third party risk management

Monitor

Get instant dashboards and spot gaps before they become issues

Report

Share fast, accurate insights with regulators and the C-suite

Financial GRC. Reimagined for Scale.

As your bank or financial institution grows, so do your risks—and so do the demands from regulators and stakeholders. SureCloud’s bank GRC software is built to support you at every stage, helping you stay in control as your business expands and the landscape shifts.

With SureCloud, you can respond to change with more agility, accuracy, and confidence. The platform brings all your risk, compliance, and third-party oversight together, making it easy to adapt as regulations evolve and your organization scales.

Enterprise Risk Management with real-time insights:

See and manage risks across all business units, using live dashboards that keep leaders and teams informed.

Automated Regulatory Compliance

For frameworks like DORA, SOX, and Basel III. Stay up to date, automate evidence collection, and keep your organization audit-ready with less manual effort.

Third-Party Risk Management with continuous monitoring:

Track, score, and respond to vendor and partner risk in real time, so you’re never caught off guard.

Audit Automation and evidence tracking:

Streamline audit preparation and evidence collection, helping your teams focus on what matters.

Executive-Level Visibility across your organization:

Deliver instant, actionable insights to the board, senior leadership, and regulators—so everyone can make confident decisions.

Starting Your Risk and Compliance Journey?

Try GRC For Growing Teams

If your team is building its approach from scratch, SureCloud’s Foundations platform is the perfect fit. Get compliance software for banks that’s easy to launch and designed to scale as your needs change.

FAQs

What frameworks does SureCloud support for financial institutions?

SureCloud supports DORA, NIS2, ISO 27001, SOC 2, SOX, Basel III, and more. Choose the modules that match your enterprise risk management for banks or regulatory compliance software needs.

Can SureCloud help us meet DORA or NIS2 requirements?

Absolutely. With our financial compliance automation and tailored workflows, you’re always ready for the latest changes.

How long does implementation take?

Most teams are live in weeks, not months, with SureCloud’s bank GRC software and onboarding support.

What makes SureCloud different from other GRC platforms?

SureCloud combines automation, real-time dashboards, and flexible reporting for a smoother compliance process. You get full oversight—no more spreadsheets or pieced-together tools.

Can I migrate away from spreadsheets or legacy GRC tools?

Yes. SureCloud makes migration simple, so you start seeing the benefits of bank GRC software and enterprise risk management for banks right away.

Discover why Specsavers’ vision for Security GRC depends on SureCloud’s assurance.

How Autotrader are automating and streamlining their risk and compliance programs with SureCloud

How Everton FC spend 75% less time documenting their processing activities and data protection impact assessments

Mollie choose SureCloud to Streamline their Risk and Compliance.

Explore how SureCloud are delivering global GRC solutions

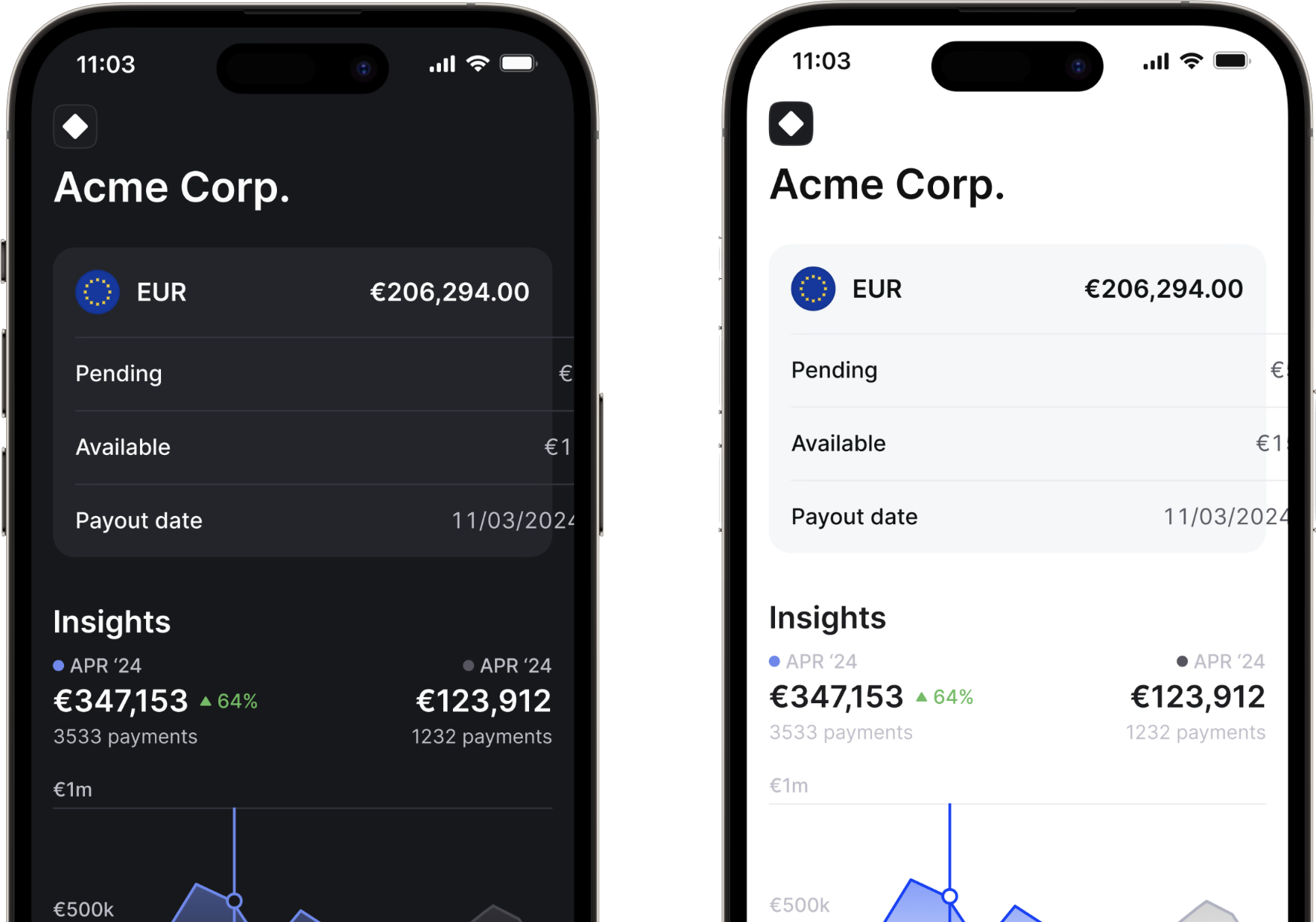

The Risk Management platform that scales with your business

Prices from:

£15,000 per year

Get compliant and stay compliant faster.

Foundation reduces the effort to meet and maintains compliance (SOC2 or ISO27001) standards by 60%.

Unlock the value within your risk and compliance landscape.

Respond to changes in your risk and compliance landscape 50% more efficiently with centralised Dynamic Risk Intelligence real-time monitoring and reporting.

The Risk Reckoning is here.

Are you ready?

Based on research with 150+ UK GRC leaders, this exclusive report from SureCloud and CIO Dive reveals the real-world disconnects, pressures, and priorities shaping Governance, Risk, and Compliance today.

%

Only 45% have an integrated approach to risk and compliance

%

Only 45% have an integrated approach to risk and compliance

%

Only 45% have an integrated approach to risk and compliance

Get the insights 150+ GRC leaders are acting on

"The SureCloud team provided a clear and well-organised process, with a proactive approach that helped move things forward efficiently and gave us confidence in their capabilities as a partner."

Discover why Specsavers’ vision for Security GRC depends on SureCloud’s assurance.

"SureCloud gave us the flexibility to design our own user journeys and reporting tools."

How Autotrader are automating and streamlining their risk and compliance programs with SureCloud.

“In SureCloud, we’re delighted to have a partner that shares in our values and vision.”

Read more on how Mollie achieved a data-driven approach to risk and compliance with SureCloud.

Explore More GRC Resources for Financial Institutions

Transform third-party risk management with SureCloud

Understanding and Complying with the DORA

.png?width=262&height=170&name=Rectangle%204318%20(1).png)

Best Security Compliance Product Award at teissAwards 2025

.png)