Achieve PCI DSS Compliance with Confidence

Ensure payment card data security with automated control mapping, audits, and continuous monitoring using SureCloud’s GRC platform

Trust Badges

PCI DSS Quick Facts

What Is PCI DSS?

PCI DSS (Payment Card Industry Data Security Standard) is the global baseline for protecting cardholder data. Any organization that accepts, processes, stores, or transmits cardholder data (CHD) or sensitive authentication data (SAD)—as a merchant or service provider—must comply. The current baseline is PCI DSS version 4.0 (with v4.0.1 clarifications). The standard defines PCI DSS controls that teams must implement and maintain across the cardholder data environment (CDE).

- Who must comply: merchants and service providers that handle cardholder data

- Data in scope: CHD and SAD (in transit and at rest)

- Versions: v3.2.1 (legacy), v4.0, and v4.0.1 (clarifications).

- Future-dated requirements: mandatory since March 31, 2025; v4.0.1 did not change this date.

- Validation: SAQ (self-assessment) or QSA-led Report on Compliance (ROC)

- Geography: global standard; applies in the UK via acquirer/brand contracts

- Consequences of PCI DSS non-compliance: fines, chargeback penalties, loss of processing privileges, reputational damage

Why PCI DSS Matters

PCI DSS is table stakes for accepting card payments: brands and acquirers require it, and it brings discipline to how you design, operate, and prove security in the CDE.

Highlights:

- Keep processing privileges and reduce financial exposure from disputes and breaches.

- Shorten SAQ/ROC prep and reduce audit exceptions with continuous evidence.

- Strengthen trust with customers and partners through demonstrable controls.

- Give leadership and regulators real-time visibility into risk and accountability.

PCI DSS Requirements & Control Objectives (v4.0 / v4.0.1)

PCI DSS is organized into six control objectives and 12 requirements. Here’s a concise view of what each requires, why it matters, and where teams get stuck.

The PCI DSS framework is built around six control objectives and twelve core requirements — the foundation for protecting cardholder data and maintaining trust. Each one plays a critical role in safeguarding systems, securing transactions, and ensuring ongoing compliance across your cardholder data environment (CDE).

Our downloadable PCI DSS v4.0 Requirements Summary goes beyond this overview — mapping each requirement to control activities, validation evidence, and common pitfalls to help you prioritise improvements faster.

Download the PDF to:

-

See the complete 6-objective, 12-requirement breakdown

-

Understand what’s changed in PCI DSS v4.0.1

-

Identify common implementation challenges

-

Get a checklist-ready summary for audit prep

How PCI DSS Compliance Works

Use a repeatable process that ties each requirement to owners, controls, and evidence.

- Scope: define the cardholder data environment (CDE), connected systems, and data flows

- Assess: perform risk and gap analysis against PCI DSS v4.0/v4.0.1

- Implement: stand up/adjust technical and procedural controls; update policies and runbooks

- Collect Evidence: capture artifacts continuously (configs, logs, approvals, test results)

- Monitor & Improve: run reviews, tests, and remediation; keep validation documents current

Audit Options

- SAQ (eligible merchants/service providers)

- QSA-led assessment for larger/complex environments

Deliverables: Self-Assessors complete an SAQ and AOC; QSA-led assessments produce a ROC and AOC.

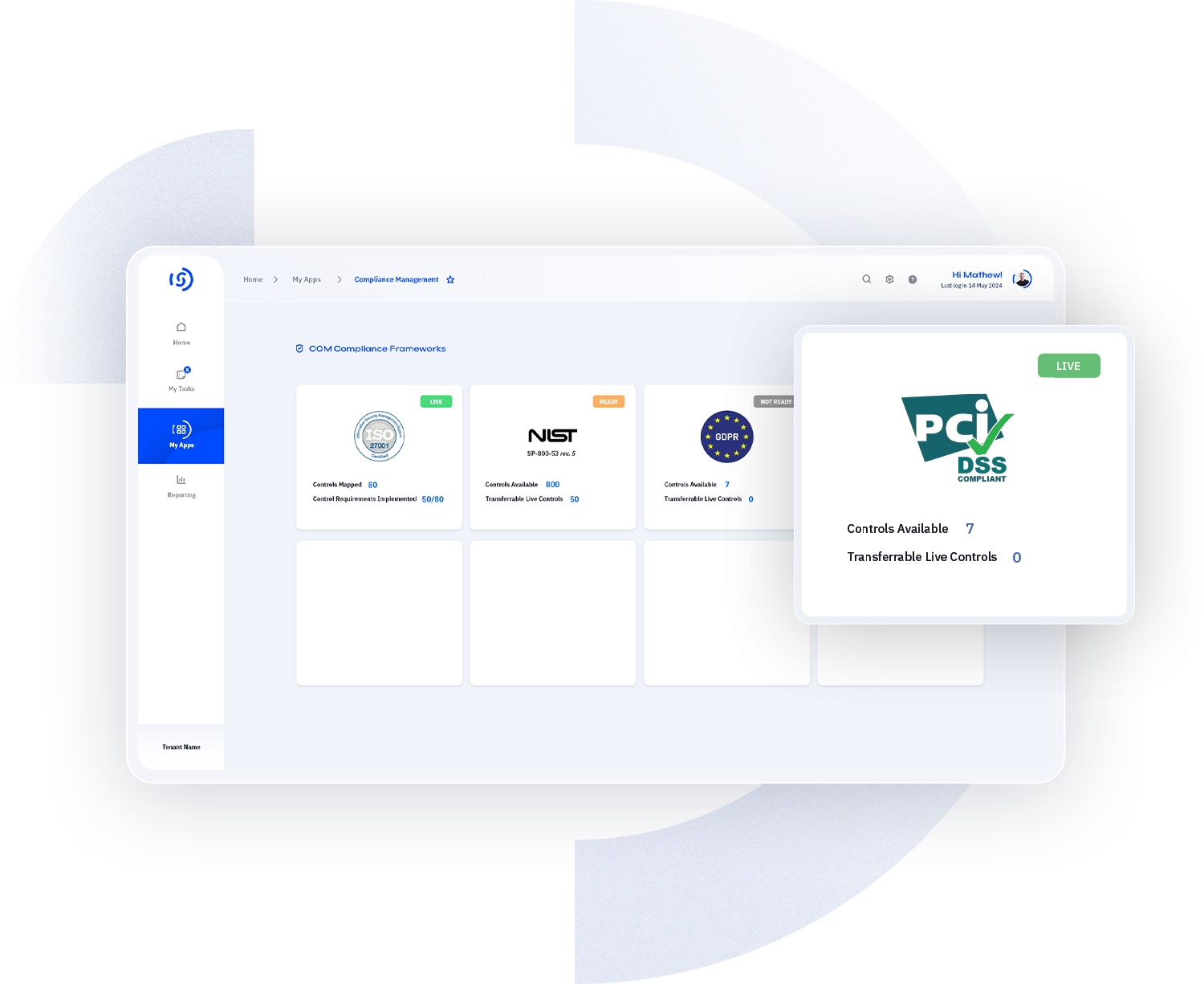

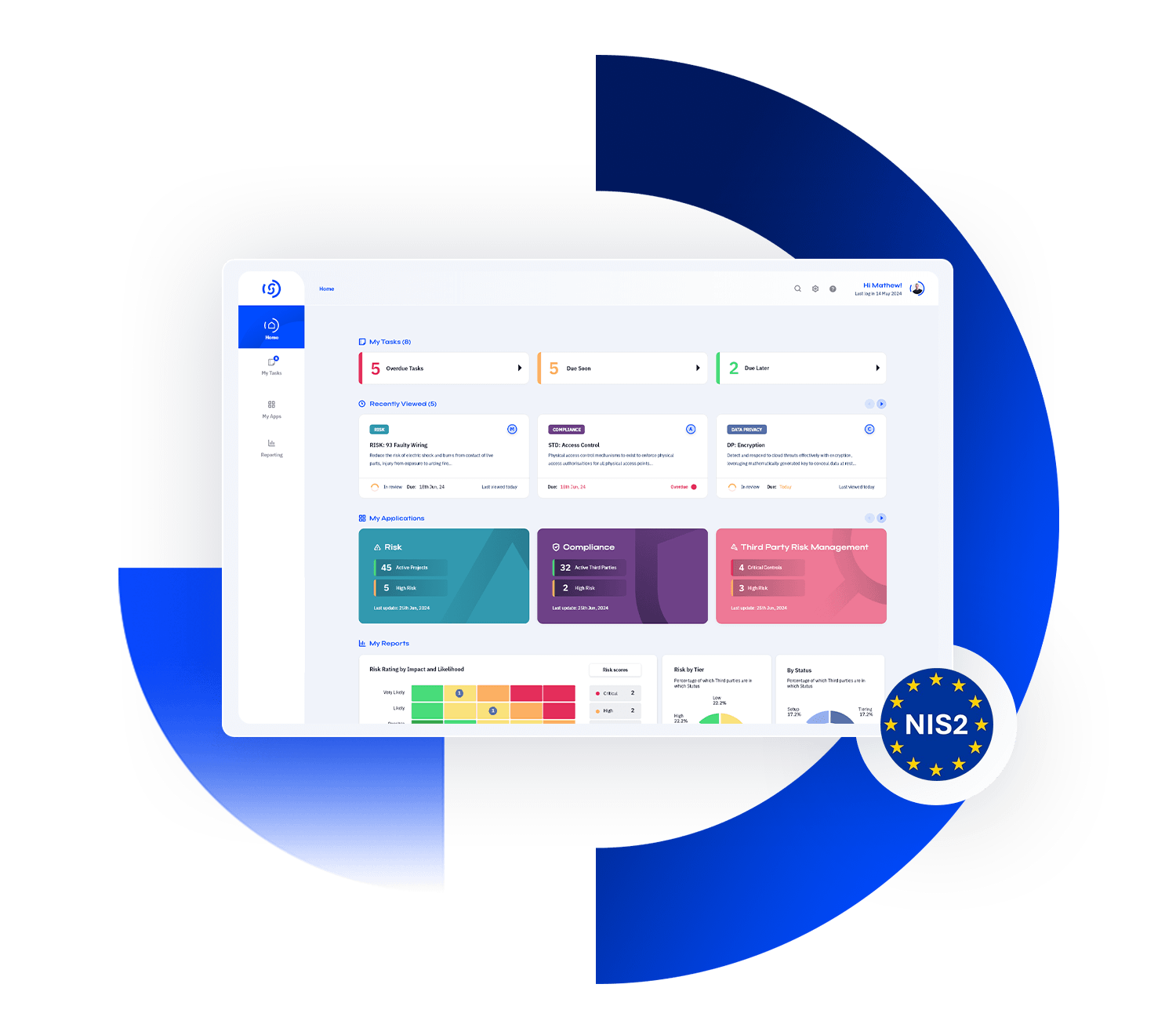

How SureCloud Simplifies PCI DSS Compliance

Make payment security controls second nature

SureCloud turns PCI DSS from a periodic scramble into day-to-day operations. In one workspace, you scope your CDE, map requirements, assign owners, automate tasks, centralize evidence, and stay audit-ready—without spreadsheets.

What You Do in SureCloud

- Scoping & Mapping: use prebuilt PCI DSS v4.0 / v4.0.1 requirement sets and a scoping wizard for CDE and data flows; map controls once and reuse across assets.

- Ownership & Workflows: assign control owners, due dates, and SLAs; automate reminders; manage exceptions and change control with an auditable trail.

- Evidence Management: store artifacts in a central repository with approvals and version history; link evidence directly to requirements for instant traceability.

- Testing & Assurance: schedule control tests and reviews; ingest ASV scan results; track pen-test findings; trigger change-based testing automatically.

- Third-Party Oversight: tier processors, gateways, hosting providers, and MSPs; run questionnaires; track issues and remediation to closure.

- Reporting & Attestation: provide real-time dashboards and export SAQ/ROC-ready packs for QSAs, acquirers, and leadership.

Benefits of Being PCI DSS Compliant

PCI DSS compliance delivers more than a clean audit. With SureCloud, you get measurable outcomes that matter to security, operations, and the business.

Reduce Breach Risk & Meet Obligations

Continuous control monitoring and clear ownership reduce exposure and help you maintain PCI DSS compliance.

Lower Audit Burden & Operating Cost

Automate evidence collection, task reminders, and reporting to cut time spent on SAQs/QSA preparation.

Continuous Visibility & Better Governance

See status, gaps, and trends in real time with dashboards and scheduled reviews.

Build Trust with Customers, Partners & Acquirers

Share audit-ready reports and show control effectiveness across your CDE and third parties.

Competitive Advantage in Sales & Renewals

Competitive Advantage in Sales & Renewals.

Prove compliance fast in due diligence, accelerate onboarding, and win/retain business.

Ready to Simplify PCI DSS Compliance?

Frequently Asked Questions

What’s the difference between PCI DSS versions (v3.2.1 vs v4.0 / v4.0.1)?

v4.0/v4.0.1 modernize requirements, emphasize continuous assessment, and add flexibility via customized approaches while raising assurance for high-risk areas.

Who needs to comply with PCI DSS? Does volume matter?

Any merchant or service provider that accepts, processes, stores, or transmits cardholder data. Transaction volume affects validation method (SAQ vs QSA), not whether PCI DSS applies.

What is the PCI DSS audit process—SAQ vs QSA?

SAQs are self-assessments for eligible entities; QSAs conduct on-site assessments for larger or complex environments and issue a Report on Compliance (ROC).

How often do we need to validate PCI DSS compliance?

Typically annually, with quarterly scans and ongoing control monitoring. Your acquirer or brand requirements may set additional cadence.

What are typical costs and timeframes?

Costs depend on scope and complexity (number of systems, data flows, and third parties). Timeframes shorten when controls, owners, and evidence are centralized and automated.

What are the consequences of PCI DSS non-compliance?

Potential fines, increased interchange/fees, chargeback penalties, mandated remediation, and possible loss of processing privileges—plus reputational damage.

.png)

_HighPerformer_Enterprise_HighPerformer.png)