All data is now stored in one secure, central platform, accessible anytime, anywhere, giving teams a single, reliable source of truth across the organisation.

Prodigy Finance Transforms Risk Management with SureCloud

Streamlining Processes and Strengthening Risk Oversight with SureCloud’s GRC Solution

Case Study: Prodigy Finance

The Challenge

Prodigy Finance is a specialist provider of postgraduate finance, offering a borderless credit model which assesses students on their future earning potential, not just their credit history.

It has funded nearly 15,000 students through their postgraduate study, across over 400 schools, and has lent $734 million in the process. 150 countries are eligible for student loans or refinancing deals through Prodigy Finance.

This global reach, a vast network of customers and reliance on sensitive personal information, including financial records, means that Prodigy Finance must meet a wide range of legal and regulatory frameworks.

Michael Light, Credit Risk Lead at Prodigy Finance said:

“We were using a wide range of different single-purpose platforms and processes to manage our Governance, Risk and Compliance (GRC) processes.

We had everything from specialist vendor software applications to manual Excel spreadsheets.

We needed to find a way of linking these various modules and ideas together, both to streamline internal management and costs, but also to improve our GRC posture.

All of the information we needed was sitting in multiple places, with no consolidation or unification.

We have approaching 100,000 unique data subjects, many of whom have made more than one application for finance, so there are some significant data management challenges.”

The SureCloud Solution

Prodigy Finance began by undertaking an extensive process mapping project to understand their current risk posture, scope out its ideal state and confirm the requirements from a risk and data management solution.

The organization spent five months viewing various vendors and platforms, drawing up a shortlist and making the final selection after a series of in-depth demonstrations.

SureCloud was chosen because of our highly user-friendly technology, ability to interlink a range of different modules to provide a single centralized source of information and controls, and the volume of functions we are able to automate.

Prodigy Finance selected and deployed four applications from SureCloud’s IT risk management, cybersecurity and data privacy management portfolios.

Deployed Capabilities

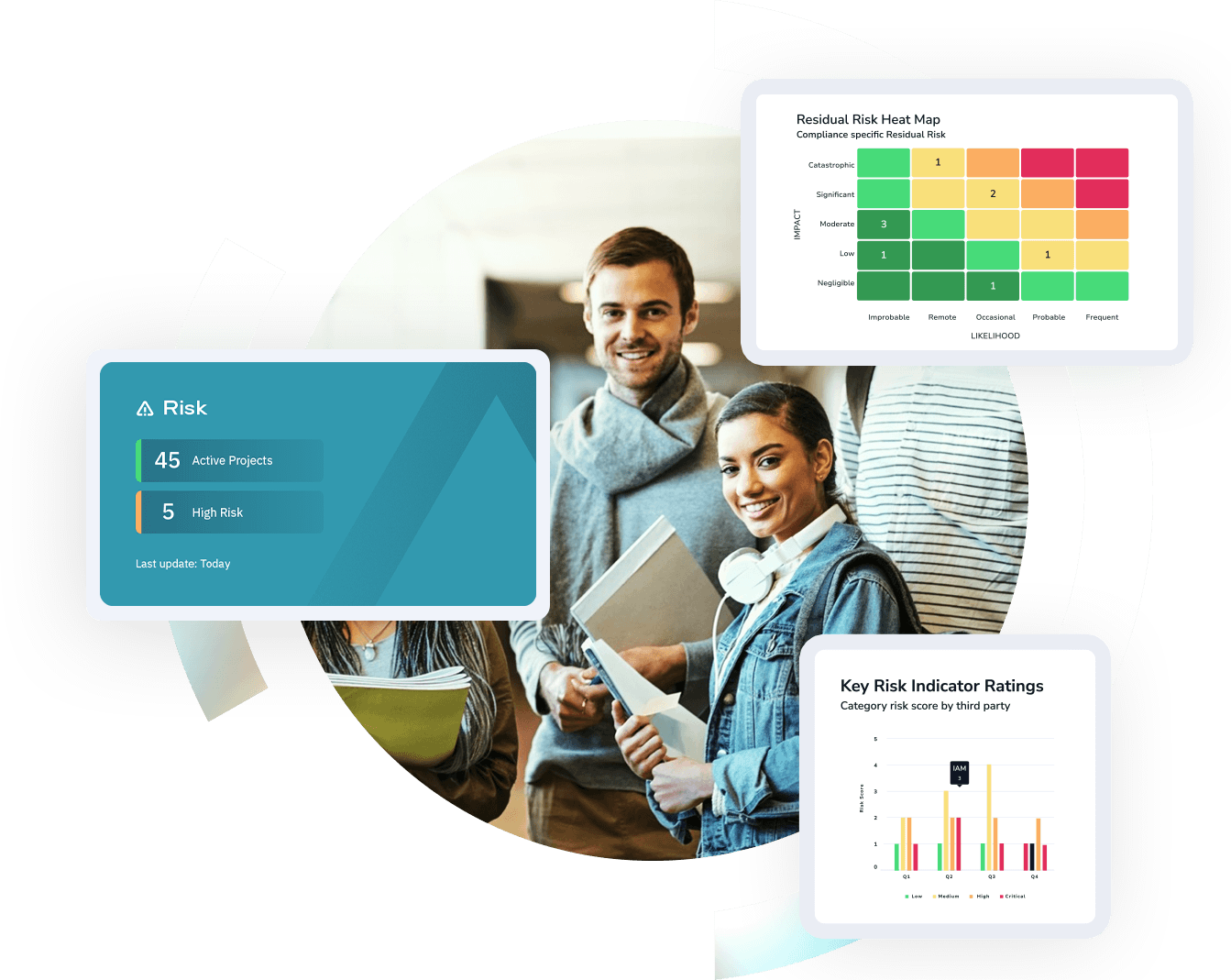

Together, these capabilities have transformed Prodigy Finance’s risk and compliance processes—delivering visibility, efficiency, and complete control from a single platform.

One Source of Truth

Full Automation

Multiple processes are now fully automated within the SureCloud platform, improving efficiency, reducing manual effort, and freeing teams to focus on higher-value tasks.

Robust security posture

SureCloud strengthened Prodigy's security stance by centralising controls, automating key checks, and ensuring consistent protection across its entire compliance ecosystem.

Comprehensive Coverage

Prodigy Finance benefits from SureCloud’s deep expertise and guidance across multiple global frameworks, ensuring consistent compliance and confidence as regulations evolve.

Data Mapping Innovation

A smarter, more connected framework was built from the ground up—enhancing accuracy, efficiency, and visibility across every stage of data management.

Centralised Data Tracking

Prodigy Finance can now record and manage large volumes of data requests in one secure, central platform. Improving efficiency, visibility and audit readiness.

Integrated GRC that’s right for you

The apps Prodigy Fiance use to streamline GRC

Enterprise Risk Package Builder

Build a tailored risk management package that aligns with your organisation’s maturity, priorities, and objectives powered by SureCloud’s flexible GRC platform.

The Risk and Compliance Management platform that scales with your business

Prices from:

£15,000 per year

Get compliant and stay compliant faster.

Foundation reduces the effort to meet and maintains compliance (SOC2 or ISO27001) standards by 60%.

Unlock the value within your risk and compliance landscape.

Respond to changes in your risk and compliance landscape 50% more efficiently with centralised Dynamic Risk Intelligence real-time monitoring and reporting.

The Risk Reckoning is here.

Are you ready?

Based on research with 200+ UK GRC leaders, this exclusive report from SureCloud reveals the real-world disconnects, pressures, and priorities shaping Governance, Risk, and Compliance today.

%

Only 45% have an integrated approach to risk and compliance

%

87% of executives claim they're prepared for a major GRC

%

98% say GRC maturity is key to operational

Get the insights 200+ GRC leaders are acting on

"Their transparent approach made the process feel collaborative and constructive, creating a solid foundation for a productive partnership.”

Read more on how Specsavers achieved a proactive approach to risk and compliance with SureCloud.

“SureCloud’s solution has brought a comprehensive clarity to data processing that was impossible to achieve with spreadsheets.”

Read more on how Everton FC achieved GDPR with SureCloud

“In SureCloud, we’re delighted to have a partner that shares in our values and vision.”

Read more on how Mollie achieved a data-driven approach to risk and compliance with SureCloud.

.png)