Guide to Regulatory Compliance How Modern Organizations Stay Ahead

Regulatory compliance has become a strategic priority for modern organizations. With evolving standards, growing data protection compliance obligations, and rising expectations from regulators and stakeholders, businesses are under pressure to prove they’re operating within legal and ethical boundaries. The cost of falling short is high—ranging from financial penalties and legal exposure to operational disruption and reputational damage.

This guide breaks down what regulatory compliance involves, why it matters, and how to meet today’s complex requirements. You’ll find a clear overview of core compliance requirements, a step-by-step look at the regulatory compliance lifecycle, and guidance on navigating common challenges. We’ll also explore how industry regulatory compliance differs by sector—and how regulatory compliance software like SureCloud can help simplify and scale your approach.

In Summary..

Regulatory compliance isn’t just about ticking boxes. It’s a strategic enabler of trust, efficiency, and resilience.

With the right frameworks, governance, and technology, modern organisations can stay ahead of evolving regulations and turn compliance into a competitive advantage.

- Understand the Fundamentals: Regulatory compliance means meeting all laws, standards, and frameworks relevant to your organisation—from GDPR to ISO 27001—ensuring you operate legally, ethically, and securely.

- Build a Proactive Strategy: Move from reactive to proactive compliance by defining objectives, assigning ownership, mapping applicable regulations, and integrating compliance into everyday operations.

- Leverage Technology: Use compliance management software like SureCloud to automate workflows, centralise evidence, and gain real-time visibility across frameworks—reducing risk and manual effort.

- Strengthen Trust and Resilience: Demonstrating strong compliance builds credibility with regulators, investors, and customers while protecting your organisation from penalties, reputational damage, and operational disruption.

What is Regulatory Compliance?

Regulatory compliance means ensuring your organisation meets the external laws, standards, and requirements that govern its operations. This covers everything from data protection and financial conduct to sector-specific obligations under UK regulations.

In practice, it involves identifying your obligations, putting the right controls in place, monitoring them consistently, and demonstrating compliance to regulators or auditors. For most organisations, this means aligning with established frameworks such as GDPR, ISO 27001, and ISO 42001.

As the regulatory landscape continues to evolve, maintaining compliance demands a structured and repeatable process that adapts to change without adding unnecessary complexity or risk.

Governance vs Compliance

Governance and compliance work together but serve different purposes. Governance is how your organization manages itself—its internal policies, controls, and culture. Compliance is about meeting external rules, including laws, regulatory frameworks, and third-party standards.

Strong governance supports compliance by embedding accountability, consistency, and visibility across the business. Together, they help reduce risk and strengthen resilience.

Examples Across Industries

Compliance looks different depending on your sector, but the fundamentals are the same:

- Financial services: Must meet FCA rules, SOX, and PCI DSS to prevent fraud and secure transactions.

- Healthcare: Required to comply with GDPR, MHRA standards, and other data protection compliance laws to safeguard patient data.

- Technology/SaaS: Commonly adopts ISO 27001 and ISO 42001 for cybersecurity and AI governance.

Typical Compliance Requirements

A strong compliance program usually includes:

- Up-to-date, documented policies and procedures

- Regular staff training on privacy, security, and compliance requirements

- Access controls and data minimization strategies

- Scheduled risk assessments and internal audits

- Breach detection, response plans, and evidence tracking

- A clear regulatory compliance checklist to manage obligations across the business

Why Regulatory Compliance Matters

Regulatory compliance isn’t just a legal requirement, it’s a strategic priority. Falling short can lead to more than financial penalties. It can disrupt operations, damage reputation, and erode stakeholder trust. In contrast, organizations that take a proactive approach to compliance are better positioned to manage risk, build resilience, and strengthen long-term performance.

Risks of Non-Compliance

- Legal Penalties and Fines: Enforcement is increasing. In 2023 alone, UK businesses paid over £45 million in ICO fines for data breaches and compliance failures. Regulatory bodies like the FCA, ICO, and EU Commission continue to tighten scrutiny.

- Reputational Damage: Non-compliance rarely stays quiet. Public breaches or investigations can impact customer trust, investor confidence, and brand perception—often with lasting consequences.

- Operational Disruption: Investigations, audits, and corrective actions drain internal resources and often force fundamental changes to how the business operates.

Strategic Benefits of Compliance

- Enhanced Resilience: A well-structured compliance program enables you to identify and address vulnerabilities early, preventing them from developing into significant risks.

- Stronger Stakeholder Trust: Demonstrating compliance reinforces confidence among customers, partners, and regulators by showing that governance and accountability are embedded in your organisation.

- Competitive Advantage: Compliance has become a key market differentiator, with many tenders and procurement processes now requiring clear evidence of it, particularly in finance, healthcare, and technology.

Key Regulatory Compliance Requirements

While requirements vary by region and sector, most fall into a few core categories. Meeting these compliance requirements is essential, not only for legal operation but also for business continuity and stakeholder confidence.

Core Frameworks and Standards

- GDPR (UK & EU): Data privacy, consent, and user rights.

- ISO 42001: AI risk management and algorithmic accountability.

- FCA Regulations: Oversight for financial services in the UK, covering fraud, reporting, and conduct rules.

- SOX: Financial transparency and internal controls for public companies.

- HIPAA: Protection of patient health information in healthcare environments.

- DORA: Digital operational resilience requirements for EU-based financial institutions.

- ISO 27001: Global benchmark for information security management systems (ISMS).

Emerging Focus: ESG Compliance

Environmental, social, and governance (ESG) regulations are adding a new layer of complexity to compliance programs. These rules focus on transparency, ethical responsibility, and long-term sustainability, particularly in finance, technology, and global supply chains. While separate from traditional regulatory mandates, ESG frameworks are increasingly interconnected with broader compliance requirements.

Sector-Specific Examples

- Finance: FCA rules, PCI DSS, and SOX for auditing, fraud prevention, and cyber resilience.

- Healthcare: GDPR, MHRA, and the Data Protection Act 2018 for privacy, consent, and clinical safety.

- Tech & SaaS: ISO 27001, ISO 42001, and NIST CSF for cybersecurity, AI oversight, and risk governance.

The Regulatory Compliance Lifecycle

Regulatory compliance isn’t a one-off task, it’s a continuous, structured process. A strong compliance lifecycle provides the foundation for consistent, auditable, and scalable compliance activity. Each stage builds on the last to ensure your organization can manage obligations, track performance, and adapt to change.

1. Discovery & Risk Assessment

Start by identifying which regulations apply to your business. This includes mapping data types, processing activities, operational regions, and industry-specific frameworks. A compliance risk assessment helps prioritize controls and assess exposure.

2. Policy Creation

Develop formal policies and procedures that align with your risk assessment. These documents act as both internal guidance and external evidence of your compliance posture.

3. Implementation of Controls

Turn policy into action by applying controls across daily operations. This includes access controls, encryption, employee training, and vendor risk management processes.

4. Monitoring & Auditing

Track the performance of your controls over time. Use internal audits, dashboards, and compliance KPIs to surface gaps, measure outcomes, and support continual improvement.

5. Incident Management & Reporting

Establish documented workflows for identifying, managing, and reporting breaches or violations. Under frameworks like GDPR and HIPAA, fast and transparent reporting is critical.

6. Review & Improvement

Regulations change and so should your program. Regular reviews help ensure your compliance strategy stays current, closes gaps, and improves over time based on audit findings and evolving standards.

Challenges in Achieving Regulatory Compliance

Even organizations with mature programs encounter obstacles that can delay audits, increase risk exposure, or reduce visibility, particularly in highly regulated or fast-changing industries.

The below challenges underscore the need for modern regulatory compliance software. Solutions like SureCloud provide a centralized platform for real-time tracking, automated workflows, and integrated risk management. Helping organizations stay ahead of audits, updates, and stakeholder expectations.

1. Evolving Regulations

From new frameworks like ISO 42001 to updates in GDPR or the FCA Handbook, regulations change quickly. Without automation or dedicated support, staying aligned can be a challenge.

2. Manual Tracking

Using spreadsheets or email to manage obligations, controls, or evidence increases the risk of oversight, errors, and missed deadlines.

3. Siloed Data

4. Lack of Real-Time Monitoring

5. Resource Constraints

Compliance requires time, expertise, and budget. Resources that many teams struggle to allocate, especially when managing multiple frameworks simultaneously.

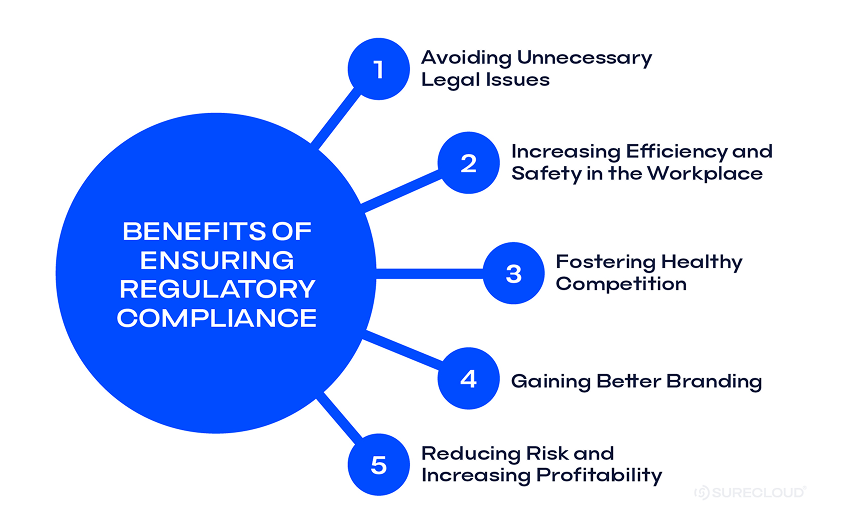

Benefits of Regulatory Compliance

Meeting regulatory compliance requirements does more than keep you out of trouble—it delivers clear business value. Organizations that treat compliance as a strategic function are better equipped to reduce risk, improve resilience, and build long-term trust with stakeholders.

Core Benefits

| Benefit | Description |

| Legal Protection | Robust compliance programs reduce exposure to legal action, penalties, and enforcement measures. Under GDPR, fines can reach €20 million or 4% of annual global turnover, highlighting the importance of proactive controls and evidence management. |

| Improved Risk Management | Compliance frameworks help identify and mitigate risks before they escalate. Controls such as regular audits, access restrictions, and documented processes lower the likelihood of security, operational, or financial incidents. |

| Competitive Advantage | Customers, partners, and investors often assess a company’s compliance maturity during procurement or onboarding. Demonstrating regulatory readiness helps your organisation stand out, particularly in sectors such as fintech, SaaS, and healthcare. |

| Stakeholder and Investor Confidence | A visible commitment to compliance shows strong governance and risk oversight. This builds credibility with regulators and stakeholders while enhancing investor confidence in high-risk or regulated environments. |

| Efficient Operations | Automating compliance tasks reduces manual effort, improves consistency, and accelerates key workflows. The outcome is faster audits, smoother onboarding, and more effective collaboration across teams. |

Building a Regulatory Compliance Strategy

A clear compliance strategy moves your organization from reactive to proactive. With defined goals, ownership, and scalable systems, compliance becomes part of day-to-day operations and evolves with regulatory change.

1. Define Objectives

Establish what your compliance program is meant to achieve. This could include avoiding penalties, enabling market expansion, meeting customer expectations, or maintaining certifications.

2. Assign Roles and Responsibilities

Define ownership for compliance across functions. Legal, IT, HR, and operations should all be involved. Appoint a dedicated compliance lead or committee to oversee implementation and track progress.

3. Map Applicable Regulations

Identify which external laws and standards apply based on your industry, services, and geographic footprint. Examples include GDPR, ISO 42001, FCA rules, HIPAA, and DORA.

4. Create Policies and Training Programmes

5. Leverage Technology

Use regulatory compliance software to automate workflows, centralize evidence, and track progress in real time. Solutions like SureCloud reduce risk, save time, and support audit readiness.

6. Integrate with Risk Management

Make compliance part of your broader risk strategy. Aligning compliance with enterprise risk management improves visibility, prevents duplication, and embeds compliance into your operational culture.

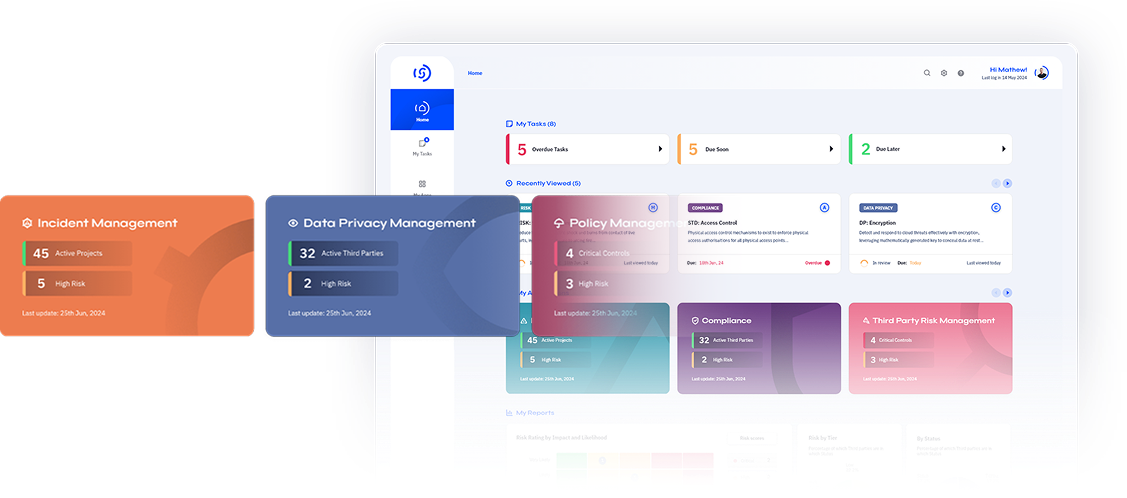

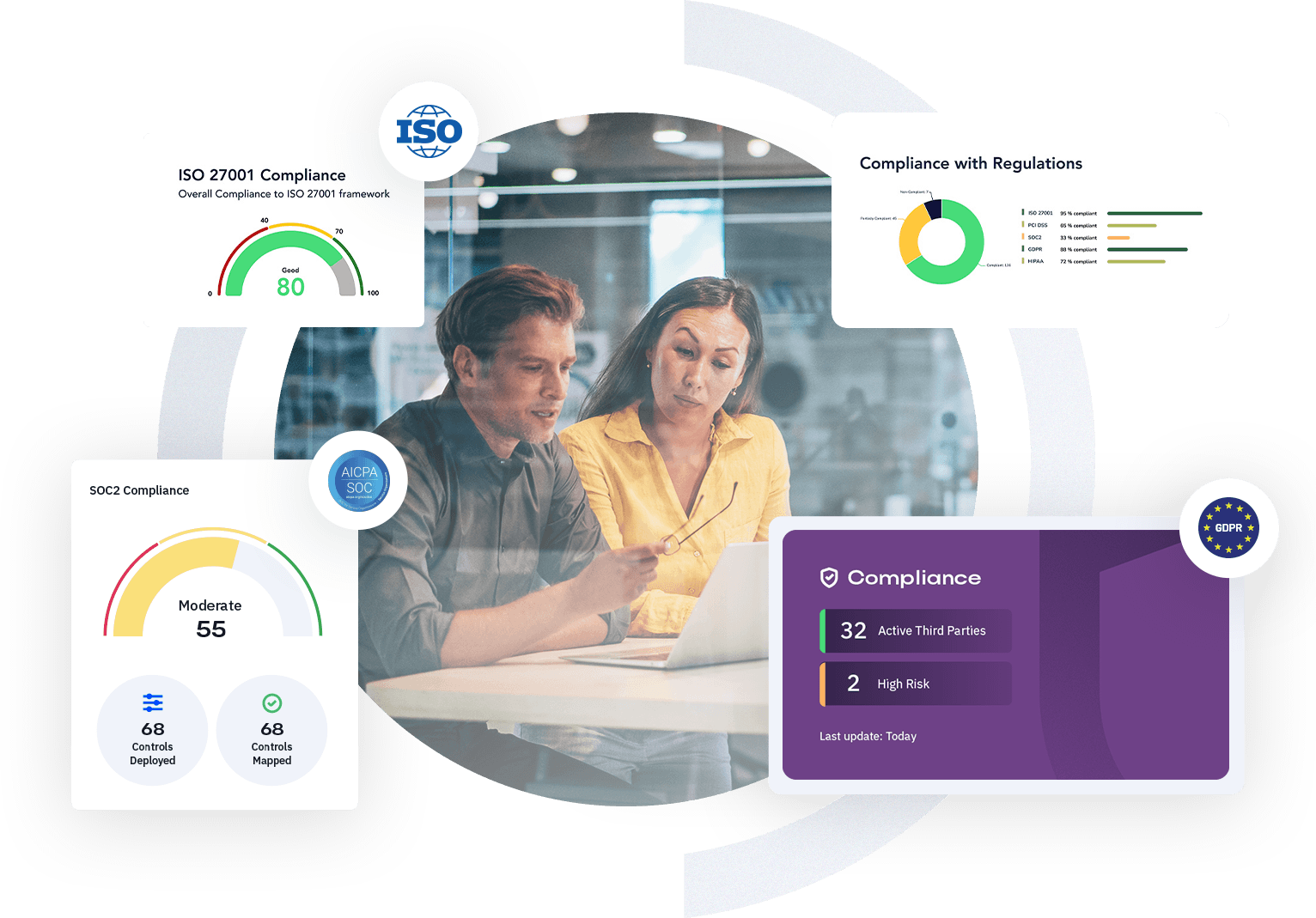

How SureCloud Supports Regulatory Compliance

Modular GRC Capabilities

SureCloud gives you the flexibility to build a tailored, scalable compliance program. Integrated modules cover the full compliance lifecycle, from policy creation to control monitoring and audit prep, while connecting seamlessly with your broader GRC workflows.

- Pre-built frameworks for GDPR, ISO 27001, ISO 42001, SOX, HIPAA, and others

- Real-time dashboards that track control status, surface gaps, and show audit readiness

- Automated evidence collection and reporting workflows

- Centralized tools to manage, update, and distribute compliance documentation

Each module is purpose-built to meet your compliance requirements and reduce manual effort across teams.

Real-World Results

Organizations like Auto Trader rely on SureCloud to manage complex, multi-framework compliance programs with confidence.

In this case study, the platform enabled faster audit preparation, improved cross-team collaboration, and enhanced visibility into control status, demonstrating how SureCloud helps regulated businesses stay responsive, audit-ready, and aligned with evolving requirements.

Expert Implementation and Support

SureCloud’s compliance specialists work with your team to align the platform to your goals and operating model. Whether you're launching a new program or refining an existing one, the onboarding process is structured, collaborative, and fully supported.

Key Takeaways & Next Steps

Regulatory compliance is no longer just about meeting minimum standards, it’s a core driver of trust, resilience, and long-term success. As regulations continue to evolve and scrutiny intensifies, organizations need a smarter, more connected approach to stay ahead. That means structured frameworks, cross-functional ownership, and the right technology to deliver clarity at every stage.

SureCloud’s regulatory compliance software gives you the visibility, automation, and scalability to turn compliance into a business advantage, not just a requirement.

Book a Personalised Demo today to see how SureCloud can support your compliance journey.

Frequently Asked Questions

What is regulatory compliance in business?

Regulatory compliance means ensuring your business meets all applicable laws, standards, and industry regulations. This includes frameworks like GDPR, ISO 27001, and ISO 42001, along with sector-specific rules from regulators such as the FCA in the UK. Compliance plays a critical role in reducing risk, maintaining trust, and avoiding enforcement action.

Which regulations apply to my industry in the UK?

UK compliance regulations vary by sector. Financial institutions may need to comply with FCA rules, SOX, and DORA. Healthcare organizations must meet MHRA and GDPR obligations. Technology companies often align with ISO 27001, ISO 42001, and broader data protection compliance standards. Your framework should reflect your industry’s specific risks and requirements.

What’s the difference between compliance and governance?

UK compliance regulations vary by sector. Financial institutions may need to comply with FCA rules, SOX, and DORA. Healthcare organizations must meet MHRA and GDPR obligations. Technology companies often align with ISO 27001, ISO 42001, and broader data protection compliance standards. Your framework should reflect your industry’s specific risks and requirements.

How do I start building a compliance framework?

Start by identifying the regulations that apply to your business. Then set clear objectives, assign responsibilities, map out compliance requirements, and implement supporting policies and training. A regulatory compliance checklist can help organize the process. Many organizations use GRC tools to support consistency and reduce manual effort.

How does compliance software help with audits?

Regulatory compliance software automates evidence collection, control tracking, and reporting, making audits faster, more accurate, and less resource-intensive. SureCloud’s platform includes real-time dashboards and alerts, so you’re always audit-ready.

What are the consequences of non-compliance?

Non-compliance can lead to fines, legal action, reputational damage, operational disruption, and a loss of stakeholder trust. Proactive compliance management reduces these risks and improves resilience.

How often should compliance reviews be conducted?

At a minimum, your compliance program should be reviewed annually. Reviews should also occur whenever your operations change or new regulations come into force. Ongoing monitoring supported by software ensures issues are caught early, between formal review cycles.

Can smaller teams afford a compliance solution like SureCloud?

Absolutely. SureCloud Foundations is designed specifically for growing teams that need structure and scalability without the complexity or cost of enterprise systems. It provides the core compliance functionality you need — from policy management to automated evidence tracking — in a modular platform that grows with your organisation. By streamlining manual processes and reducing administrative effort, Foundations helps you achieve compliance confidence faster and more affordably.

Ready to take the first step?

Align with the DORA framework

Simplify ICT risk management

Automate incident workflows and reporting

Centralize third-party oversight

Stay DORA compliant at scale

Book a demo to see how SureCloud can support your DORA compliance journey — from policy to proof.

Read more from the SureCloud blog:

"Excellent support team" We've been happy with the product and the support and communication has been excellent throughout the migration and onboarding process.

G2 - SureCloud

"Excellent support team" We've been happy with the product and the support and communication has been excellent throughout the migration and onboarding process.

G2 - SureCloud

"Excellent support team" We've been happy with the product and the support and communication has been excellent throughout the migration and onboarding process.

G2 - SureCloud

"Excellent support team" We've been happy with the product and the support and communication has been excellent throughout the migration and onboarding process.

G2 - SureCloud

"Excellent support team" We've been happy with the product and the support and communication has been excellent throughout the migration and onboarding process.

G2 - SureCloud

.png)

_HighPerformer_Enterprise_HighPerformer.png)