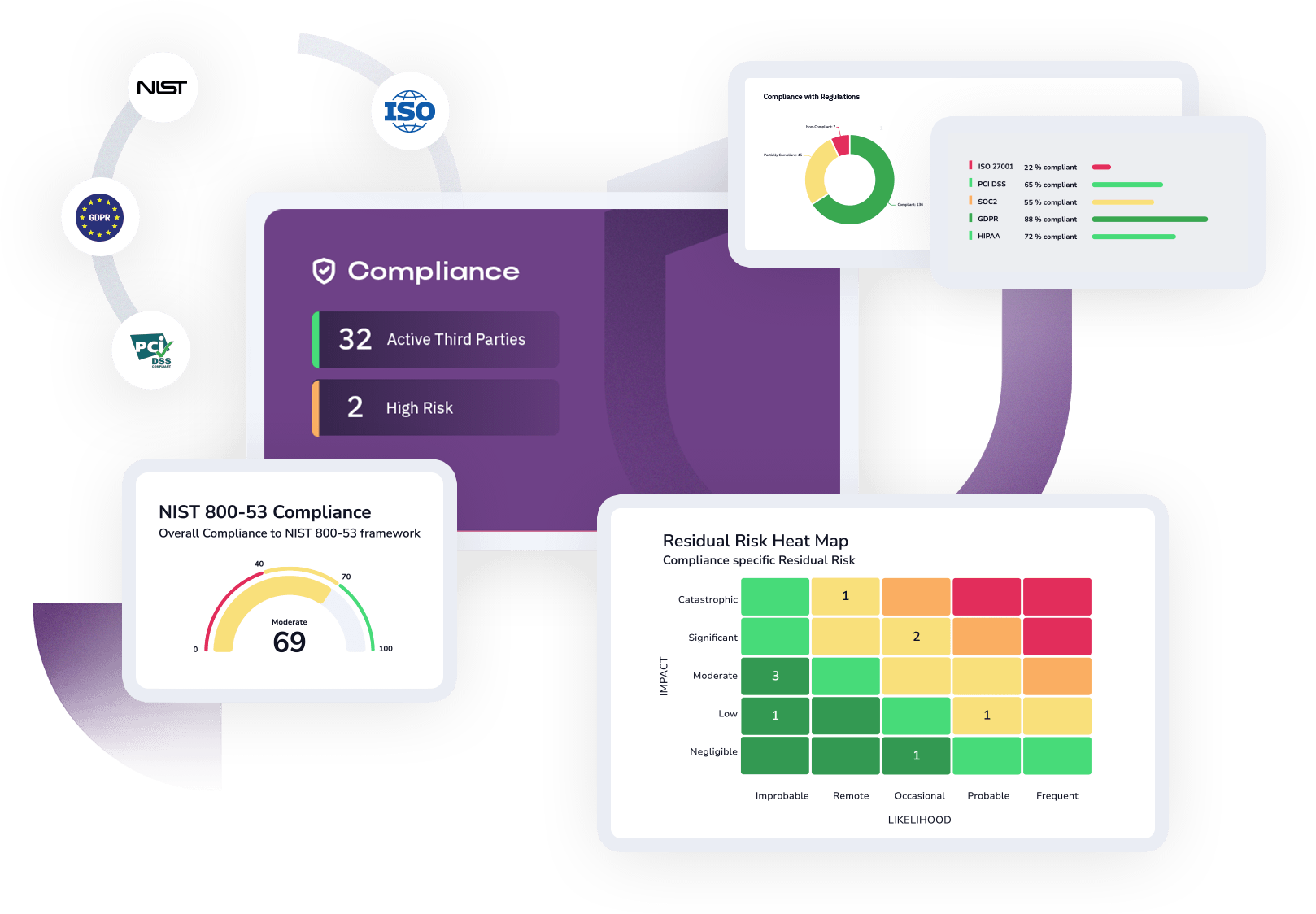

Compliance Management

Seamlessly manage your complex compliance requirements

Regulations, standards and frameworks are evolving on a near-constant basis and getting a grasp on them can be an arduous task. Customer demand for certifications is more stringent and the ability to demonstrate compliance to internal and external stakeholders is critical to many organizations’ license to sell. SureCloud’s Compliance Management solution enables you to manage your compliance requirements end-to-end to ensure you can obtain the assurance you need.

Clever compliance driven by ready automation

Accelerate compliance out-the-box

Leverage pre-built controls aligned to best practice frameworks and your very own controls library.

Simplify regulatory adherence

Use continuous controls monitoring (CCM) to seamlessly evaluate against multiple regulations with a holistic SureCloud Controls Framework that eliminates duplication and reduces assessment fatigue.

Validate controls with confidence

Conduct self-assessments and deep dive testing of controls to ensure they are operating effectively.

Improve your insights

Demonstrate progress with granular compliance status reporting at the business unit, regulation and citation level.

What’s your compliance challenge?

“We end up duplicating a lot of work to meet multiple compliance requirements.”

What’s your compliance challenge?

“A siloed approach means it’s hard to collaborate with stakeholders on compliance.”

What’s your compliance challenge?

“The manual process of reviewing control updates is time consuming.”

What’s your compliance challenge?

"We're having trouble managing updates to compliance requirements across multiple jurisdictions"

Get accreditation the easy way

Automate Compliance Workflows

Reduce cost and duplication of work through pre-built workflows, automated notifications for control reviews and integrated control mapping across multiple regulations, standards and frameworks including ISO 27001, PCI-DSS and GDPR.

Empower Teams to Collaborate in Real Time

The SureCloud platform has been designed to allow users to actively collaborate on controls, reviews, and workflows in real-time to ensure a truly cohesive, transparent, and collaborative experience for every team, across every project.

Proactively Track and Report on Compliance

Use pre-built dashboards or configure your own to report on multiple levels of compliance data. Make your reporting work for you to demonstrate your compliance programs progress in a way that meets your stakeholders' expectations.

Integrate Seamlessly with Tools

The SureCloud platform comes with out-of-the-box integrations for tools widely used cross-industry such as JIRA and ServiceNow to ensure you can seamlessly integrate and optimise your processes with your existing business applications.

Frameworks

SureCloud supports a range of frameworks and standards to support compliance management, including:

ISO 27001

Protect data and comply with ISO 27001.

ISO 27002

Strengthen security with ISO 27002 controls.

SOC 2

Quickly achieve SOC 2 for data compliance.

NIST CSF

Manage cyber risk with better guidance and controls.

GDPR

Continuously manage and report on your compliance status.

SCF

Cybersecurity and privacy across all levels.

The intelligent GRC platform that scales with your business

Prices from:

£15,000 per year

Get compliant and stay compliant faster.

Foundation reduces the effort to meet and maintains compliance (SOC2 or ISO27001) standards by 60%.

Unlock the value within your risk and compliance landscape.

Respond to changes in your risk and compliance landscape 50% more efficiently. Take centralised command of your risk, compliance, audit and privacy activities.

FAQ’s

What is SureCloud's Compliance Management Software?

It’s a cloud-based compliance management solution that helps organisations manage regulatory, standards- and policy-based requirements end-to-end. Replacing spreadsheets, email threads and fragmented tools with a unified, automated platform.

Which kinds of organisations or teams benefit most from Compliance Management?

It works for small or growing teams (who may only need core compliance support) as well as for larger enterprises managing complex compliance, audit, risk, and control frameworks.

Many regulated sectors, e.g. finance, healthcare, tech, and manufacturing, find it particularly valuable given their compliance demands.

Which standards, regulations, or frameworks does it support?

SureCloud supports a broad set of frameworks and regulations, including but not limited to ISO 27001, ISO 27002, SOC 2, GDPR, NIST CSF, DORA and others, helping you cover multiple compliance regimes in one place.

How does it help reduce manual work and duplication when managing compliance?

The platform provides pre-built controls aligned to best-practice frameworks, automated workflows, integrated control mapping and continuous controls monitoring (CCM). This reduces duplication and cuts down on time-consuming manual reviews across multiple standards or regulations.

Can different teams collaborate on compliance work in real time using SureCloud?

Yes, SureCloud is designed for collaboration. Multiple stakeholders can work on control reviews, self-assessments, testing, and reporting in real time, helping to coordinate across departments and breaking down silos.

How do we track progress and report compliance status?

The platform provides dashboards and customizable reporting tools. You can monitor compliance status at many levels: by business unit, by regulation/framework, or even by individual citation/control. This makes it easier to show audit-ready status and progress over time.

Is SureCloud scalable? Can it grow as our business and compliance needs grow?

Yes. Whether you’re a small team starting out or a large enterprise with complex needs, SureCloud’s modular platform lets you scale up, adding risk, audit, third-party risk, data privacy or other modules as needed.

What if we need to meet multiple regulations or frameworks at once? Does it handle that?

Absolutely, SureCloud supports multi-framework compliance, and its control-mapping helps avoid duplicate work when controls overlap across regulations. That way, you manage compliance holistically rather than in silos.

How quickly can a team get started with SureCloud?

For many organisations, especially those starting their compliance journey, setup can be relatively rapid, allowing you to move away from spreadsheets and manual processes quickly.

What kinds of integrations does it support? Does it work with other tools we already use?

SureCloud offers out-of-the-box integrations with common enterprise tools (e.g. ticketing or ITSM systems) so you can embed compliance workflows into existing processes rather than reinventing them.

Get quick clarity on how SureCloud can transform your compliance processes.

“In SureCloud, we’re delighted to have a partner that shares in our values and vision.”

Read more on how Mollie achieved a data-driven approach to risk and compliance with SureCloud.

“SureCloud’s solution has brought a comprehensive clarity to data processing that was impossible to achieve with spreadsheets.”

Read more on how Everton FC achieved GDPR with SureCloud

"Their transparent approach made the process feel collaborative and constructive, creating a solid foundation for a productive partnership.”

Read more on how Specsavers achieved a proactive approach to risk and compliance with SureCloud.

Seamless integrations for Compliance

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

The Risk Reckoning is here.

Are you ready?

Based on research with 200+ UK GRC leaders, this exclusive report from SureCloud reveals the real-world disconnects, pressures, and priorities shaping Governance, Risk, and Compliance today.

%

Only 45% have an integrated approach to risk and compliance

%

of executives claim they're prepared for a major GRC event

%

say GRC maturity is key to operational success

Get the insights 200+ GRC leaders are acting on

.png)